Welcome to Your TaxClosure Day

Same Day IRS Tax Relief

Simple, Fast & Easy

The only 40-year proven IRS Tax Relief Solution is HERE—at the Guaranteed Lowest Cost ... as low as $86 per month

.png?width=790&height=682&name=Group-488-(2).png)

Created by America’s FIRST Tax Resolution Firm

Low Cost IRS Resolution

Thousands less for the Best.

Simple Walkthrough

Our platform walks you through the tax resolution process, line by line, to make each step an easy one.

.svg)

Guidance for Every IRS Question

Our videos explain the answer to every common and uncommon question that could arise throughout the short process.

90% of our clients have seen their back-taxes waived, while the remaining 10% benefit from affordable pay plans.

Customer Reviews

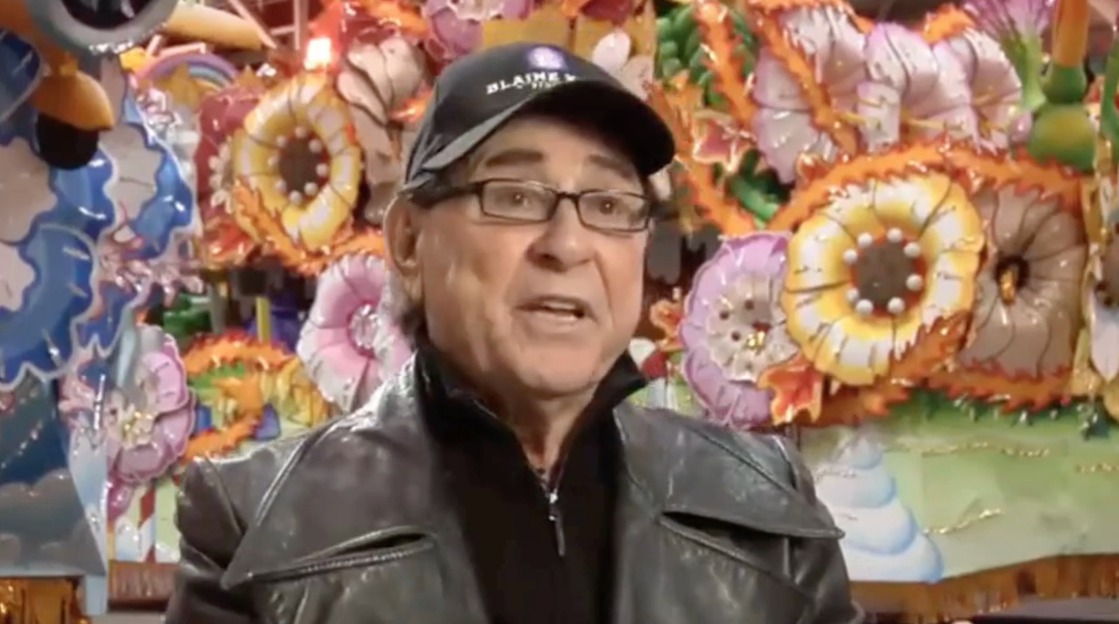

"Mardi Gras is a big business. When I first started it, it was a $100,000 a year industry 65 years ago. But now it's over a billion dollar a year industry involving millions of people. In 2010, after...

"Mardi Gras is a big business. When I first started it, it was a $100,000 a year industry 65 years ago. But now it's over a billion dollar a year industry involving millions of people. In 2010, after 63 years of being in business, a very successful business, all of a sudden the IRS was coming down on me, but not only on me, but all of my customers and Blaine Kern artists. We are Mardi Gras, we do 80% of every major crew.

Well with TaxClosure, I was able to get the levies taken off, and this was incredible because those levies were $80,000 and $100,000 on different customers. I couldn't believe it. I was so thankful to TaxClosure. I mean, they literally saved Mardi Gras, but they also saved my reputation. And let me tell you, the only thing you've got in your life is your reputation.

Thanks to TaxClosure, I'm in good with the IRS. Mardi Gras is going on as usual, and I advise anybody that has problems, call TaxClosure. Today."

"I ran into my own tax issues, everybody does. I didn't know which way to turn. I didn't know where to go. Who do you call? I didn't have enough money to pay those taxes. I sure am not going to...

"I ran into my own tax issues, everybody does. I didn't know which way to turn. I didn't know where to go.

Who do you call?

I didn't have enough money to pay those taxes. I sure am not going to have enough money to pay a tax attorney. Since getting TaxClosure, I'm fine. My business is fine. Everything is back to normal. It's the single greatest product I've seen out there that can provide resolution for families under pressure and corporations alike."

"I found that I owe the IRS close to $65,000. It was quite frustrating, very, very frustrating to see all this stuff piling up in my mailbox, you know, after going through a divorce then losing the...

"I found that I owe the IRS close to $65,000. It was quite frustrating, very, very frustrating to see all this stuff piling up in my mailbox, you know, after going through a divorce then losing the job and now the IRS is after me. So, it was pretty ugly. It's been a year since I went through TaxClosure and it's amazing. Night and day, the phone calls stopped and the closure's there.

If you have tax problems, I would highly recommend TaxClosure."

" I basically did everything wrong with my tax debt to the IRS. TaxClosure showed me that this can be a very simple process with the right expert guidance. Here are some of the keys that I learned...

" I basically did everything wrong with my tax debt to the IRS. TaxClosure showed me that this can be a very simple process with the right expert guidance. Here are some of the keys that I learned from TaxClosure.

One, it's just a flat rate. So regardless of how much you owe, you just pay one rate for everyone.

The second is, it's a simple process of just filling out some forms. But, you have to do it the right way with the right expert guidance. TaxClosure guides you through this process with step by step videos of exactly how to fill out the forms in order to qualify for a low pay or a no pay with the IRS, so that you can get this resolved.

You don't need a huge team of lawyers. You don't need to wait months and months and months. You don't need a long drawn out service.

TaxClosure has the best, the simplest, the most streamlined way to fix your tax debt. I know because I've been through it all. Thanks TaxClosure for all you do.

For everyone out there, get ready to fix this issue quickly and easily."

"Now that I’ve completed the process with TaxClosure, I have more freedom, and I sleep better at night. The IRS Boogieman isn’t under my bed anymore!"

"Now that I’ve completed the process with TaxClosure, I have more freedom, and I sleep better at night. The IRS Boogieman isn’t under my bed anymore!"

"The IRS quit calling, they quit sending letters and they released the levies on our accounts. The fear was gone!"

"The IRS quit calling, they quit sending letters and they released the levies on our accounts. The fear was gone!"

"Tried dealing with the IRS on my own and it didn’t work. I used TaxClosure and now I’m $72,000 better off. Don’t wait. This works!"

"Tried dealing with the IRS on my own and it didn’t work. I used TaxClosure and now I’m $72,000 better off. Don’t wait. This works!"

"TaxClosure has lifted a burden off of me that I never thought would go away."

"TaxClosure has lifted a burden off of me that I never thought would go away."

"We used TaxClosure’s methodology and almost overnight the problem went away."

"We used TaxClosure’s methodology and almost overnight the problem went away."